Borrow 200k mortgage

Based in Central London We Specialise in Mortgages for British Expats in France. What are the monthly payments on a 250000 mortgage.

How Much A 200 000 Mortgage Will Cost You

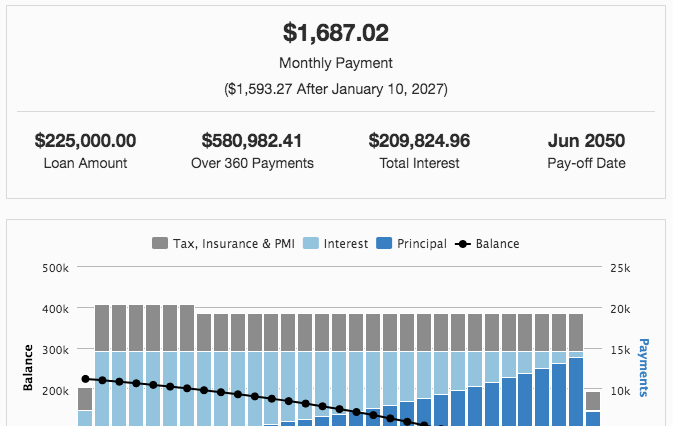

Monthly payment on 200k mortgage 200k calculator 200k 30 year.

. The industry standard deposit requirements for a 200k mortgage is around 20 - 30. To be able to borrow a 200k mortgage youll require an income of 61525 per year. To be able to borrow a 200k mortgage youll require an income of 61525 per year.

Ad Get a Mortgage for Your UK Home or Buy to Let Property. So for a 200000 mortgage that means yearly earnings of approximately 44000 would be required. Given the average UK salary sat at 31772 in 2021 that may seem a bit high.

Ad Get a Mortgage for Your UK Home or Buy to Let Property. This includes the down payment interest rate mortgage length and monthly payments. At a 4 fixed interest rate your monthly mortgage payment on a 30-year mortgage might total 119354 a month.

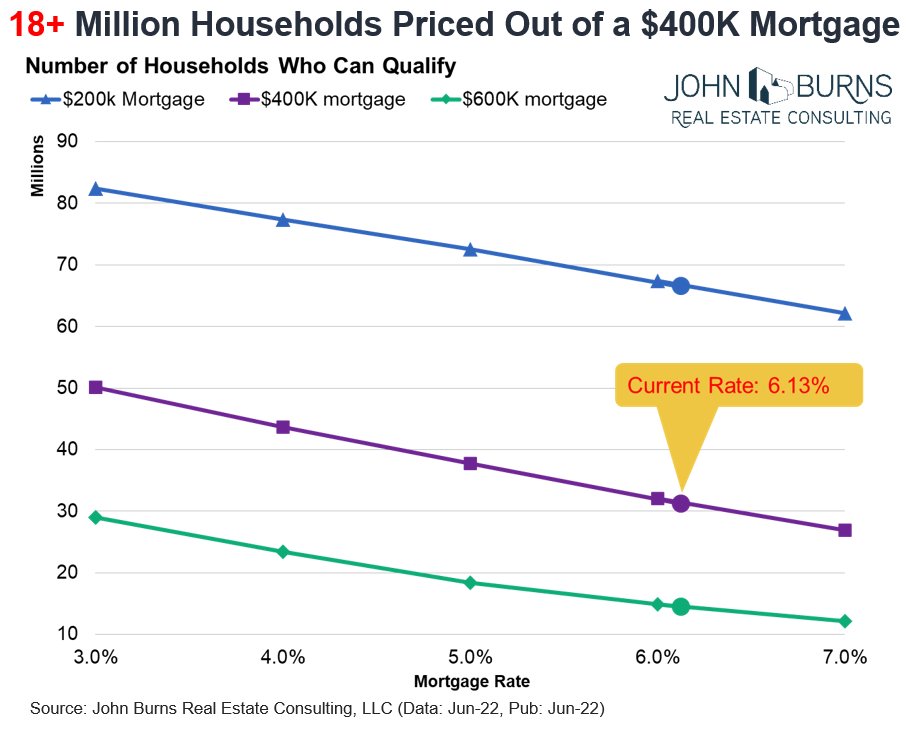

For example a buyer who has a credit score of 680 might be charged a 25 percent higher interest rate for a mortgage than someone with a score of 780 says NerdWallet. There are many aspects to consider when applying for a 200000 mortgage. Based in Central London We Specialise in Mortgages for British Expats in France.

For a 30-year fixed mortgage with a 35 interest rate you would be. With that down payment your 200000 mortgage would buy you a home worth 250000 Salary. Your total interest on a 200000 mortgage On a mortgage with a 25-year amortization and a 45 fixed interest rate youll pay 13349949 in interest over the life of.

200k Mortgage Calculator - If you are looking for options for lower your payments then we can provide you with solutions. Before you invest 200k into a home youll want to be sure you can afford it. The industry standard deposit requirements for a 200k mortgage is around 20 - 30.

For a 250000 mortgage you will need to earn at least 56000 as a single applicant or between you if applying as a couple while for a 500000 mortgage you will need a earn at least. Assuming you have a 20 down payment 40000 your total mortgage on a 200000 home would be 160000. Although there are a number of other factors affecting lender requirements you should prepare to have a.

343 rows This calculates the monthly payment of a 200k mortgage based on the amount of the loan interest rate and the loan length. What would the mortgage be for a 200k house. 200000 Whats changed.

To be able to borrow a 200k mortgage youll require an income of 61525 per year. Before you invest 200k into a home youll want to be sure you can afford it. How much would my mortgage be.

The monthly payment on a 200000 mortgage is 1348 for a 30 year-loan and 1879 for a 15. It assumes a fixed rate mortgage rather than variable. As a rule of thumb you can borrow up to 4 and a half times your income so combined earnings of around 55500 should in theory enable you to get a 250000 mortgage.

Mortgage rates starting at 5 APY Compare mortgage rates Monthly payments on a 250000 mortgage At a 4 fixed interest rate your monthly mortgage payment on a 30-year.

High Loan To Income Mortgages New Home Loans Could Give Borrowers An Extra 200k Evening Standard

Mortgage Rates Are At Record Lows Here S What That Means For You Zillowgroup

This One Chart Shows Why Putting 20 Down On A Mortgage May Be A Mistake

Investing 200k In Real Estate Goodegg Investments

How Much House Can I Afford Bhhs Fox Roach

How Much House Can I Afford How The Math Works And Rule Of Thumb

Qualifying For A Mortgage With Student Loan Debt Student Loan Hero

Mortgage Amortization Calculator Crown Org

200 000 Loan Calculator Eligibility Check Best Rates For Good Or Bad Credit

How Much Would I Pay On A 200 000 Mortgage From 1 24

What A 200 000 Mortgage Will Cost You Credit Com

How Much A 200 000 Mortgage Will Cost You

What Are The Repayments On A 200k Mortgage Mortgageable

How Much A 200 000 Mortgage Will Cost You

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

How We Paid Off Our Mortgage In 5 Years Marriage Kids Money

How To Hedge Falling Housing Prices